Thailand is the second-largest economy in Southeast Asia and a great location for companies looking to access skilled talent. With a GDP of over USD 500B, its economy is reliant on exports and a massive service sector. Key industries include automotive manufacturing — like pickup trucks, electronics, and electrical appliances — and agricultural products — like rubber and rice —. Current government initiatives are focused on developing a talent pool in advanced manufacturing, digital technology, and green industries.

Before expanding into Thailand, you’ll need to understand contracts, taxes, wages, benefits, and other employment laws. Our guide will tell you everything you need to know about hiring in Thailand.

What to know before hiring in Thailand

If you’re expanding your business into Thailand for the first time, there are important legal requirements to be aware of. These norms and laws influence hiring practices in Thailand and many aspects of the employer-employee relationship, including compensation and benefits.

G-P Gia™, our AI-powered global HR agent, can answer your toughest compliance questions across 50 countries — including Thailand — and all 50 U.S. states. Reduce your reliance on outside counsel and cut the time and cost of compliance by up to 95% with Gia.

Here are five things to know about hiring employees in Thailand.

1.Contract employment in Thailand

Thai law has written and verbal employment contracts. Written contracts are strongly recommended for clarity and to avoid disputes.

Fixed-term and permanent contracts are allowed. Fixed-term contracts have to be in writing and are used for temporary, project-based, or seasonal work. Permanent contracts are the default and most common.

There’s no maximum time period for probation. The common practice is to limit probation to 119 days. Employees offboarded before 120 days of service aren’t entitled to severance pay. For indefinite contracts, a written notice of one month is needed for termination without cause. Payment in lieu of notice is allowed.

It’s best practice to include clear details on the position, compensation, benefits, and termination conditions. We recommend drafting bilingual contracts for global employees. Note that the Thai version will prevail in a legal dispute.

2. Payroll and taxes in Thailand

Employers and employees contribute 5% of the employee’s monthly salary to the social security fund (SSF). Contributions are capped at THB 15,000 per month. The maximum monthly contribution for employer and employee is THB 750 each. The SSF offers benefits including medical care, child allowance, unemployment, disability, maternity, retirement pensions, and funeral assistance.

Corporate income tax in Thailand is 20% of a company’s net profits. For small and medium-sized enterprises (SMEs), lower progressive rates can apply to the first THB 3M of net profit. Corporate tax is calculated annually.

3. Wages and working hours in Thailand

The maximum is eight hours per day and 48 hours per week. For hazardous work, the limit is seven hours per day and 42 hours per week. Employees get one rest day per week. The interval between rest days can’t exceed six days.

Overtime is allowed up to 36 hours per week. Overtime pay on normal working days is 1.5 times the normal hourly wage. Overtime on holidays or rest days is three times the normal hourly wage.

Minimum wage varies by province. In 2025, the range is between THB 337–400 per day.

4. Time off in Thailand

Employees get a minimum of six working days of paid annual leave per year after one year of continuous service. Employers can give more (10–15 days is common), but this isn’t required by law.

Carryover of unused annual leave is allowed by mutual agreement. Payment for unused leave is required upon termination.

Employees get 13 paid holidays per year, including the three-day Songkran festival. If a holiday falls on a rest day, a substitute holiday has to be provided.

Employees get up to 30 paid sick days per year. A medical certificate is required for absences of three or more consecutive days. If illness or injury is work-related, this is covered separately under workmen’s compensation and doesn’t count against sick leave.

Expecting employees get 98 days of maternity leave per pregnancy. This includes holidays and rest days. The employer pays for 45 days. The social security fund pays for up to another 45 days for insured employees. The remaining eight days are unpaid.

A law to increase maternity leave to 120 days (with 60 days paid by the employer) and 15 days of paid paternity leave for the private sector has been approved by parliament but hasn’t been enforced yet.

Eligible employees get up to 60 days of paid leave per year for military service or exercises. Paid leave is provided for medical sterilization procedures. Employees get up to three paid days per year for personal business.

5. Anti-discrimination law in Thailand

Thailand’s anti-discrimination protections are grounded in:

-

The 2017 constitution

-

Labor protection act B.E. 2541 (1998)

-

Gender equality act B.E. 2558 (2015)

-

The persons with disabilities empowerment act B.E. 2550 (2007)

The constitution doesn’t allow discrimination based on:

-

Origin

-

Race

-

Language

-

Sex

-

Age

-

Disability

-

Physical or health condition

-

Personal status

-

Economic or social standing

-

Religious belief

-

Education

-

Political opinion

The labor protection act prohibits gender discrimination and mandates equal pay for equal work. Union activity is protected under the labor relations act.

The gender equality act covers gender, gender identity, and gender expression, and prohibits unfair gender-based discrimination. Sexual orientation isn’t listed in law but can be interpreted as protected under the gender equality act and the broad constitutional provisions.

The persons with disabilities empowerment act prohibits discrimination against people with disabilities.

Top hiring hubs in Thailand

Some cities in Thailand are known for particular industries. Knowing what each region has to offer allows you to focus your hiring efforts in the right place and fill roles faster.

The top talent hubs in Thailand are:

-

Bangkok is the capital and largest city in Thailand. Bangkok is Thailand’s main business, financial, and technology hub. The greater Bangkok metropolitan region accounts for an estimated 40–50% of the country’s GDP.

-

Chiang Maui is considered one of the best places for digital nomads globally. This popularity helps the local economy through co-working spaces, fast fiber-optic internet, and hospitality services.

-

Chonburi (including Pattaya and the eastern economic corridor) is an industrial and logistics hub, home to manufacturing, automotive, technology companies, and international business parks. The Laem Chabang deep sea port is Thailand's largest container port. This makes Chonburi important for supply chain management, customs, and logistics talent.

-

Phuket is traditionally known for tourism and hospitality. But the city is developing as a hub for digital professionals and creative industries.

-

Rayong is part of the EEC. The province's industries focus on petroleum engineering, chemical processing, and manufacturing of polymers and plastics. The Map Ta Phut industrial estate in Rayong is one of the world's largest petrochemical hubs.

Key industries in Thailand

Understanding Thailand’s top industries allows you to benchmark salaries and benefits. You can use this insight to make smart choices about where to invest and grow your talent pool.

The top industries in Thailand include:

-

Manufacturing: This is the backbone of Thailand’s economy, especially in sectors like automotive, electronics, machinery, and food processing. Manufacturing employs 16% of the national labor force.

-

Agriculture and food processing: Thailand is a leading exporter of rice, seafood, rubber, sugar, and processed foods.

-

Automotive: The country is an automotive manufacturing hub in southeast Asia, producing cars and auto parts for export and domestic use. Thailand is known globally as a hub for 1-ton pickup truck production.

-

Electronics and electrical appliances: Thailand is a large producer of hard drives, semiconductors, and consumer electronics. The country is the world's second-largest producer of air conditioning units and a main exporter of refrigerators, washing machines, and compressors.

-

Petrochemicals and chemicals: The EEC has many petrochemical plants and related industries.

The cost of hiring an employee in Thailand

Whether you’re hiring one employee or an entire team in Thailand, expenses are inevitable. Budget for the following:

-

Setting up an entity (unless you partner with an employer of record)

-

Advertising job positions

-

Paying referral bonuses to employees with connections in Thailand

-

Paying an in-house hiring committee

-

Traveling to and from Thailand, including hotel stays, meals, and transportation

-

Partnering with a translator to draft documents or facilitate conversations (if applicable)

-

Using a background check service for screening candidates

-

Drafting employment contracts, legal review, and consultation with HR and legal experts

-

Costs for providing computers, phones, and software licenses

-

Onboarding materials and initial training

-

Costs for maintaining required tax and payroll records and documentation

According to G-P Verified Sources from Gia, the employer burden rate in Thailand, which includes costs triggered on top of salaries, is about 5.2–6%, excluding accident insurance that can vary.

What does a company need to hire employees in Thailand?

Make sure you cover these essentials before expanding your team in Thailand:

-

Register your company with the department of business development (DBD).

-

Get a tax ID and register for VAT.

-

Open a local bank account.

-

Register as an employer and enroll employees with the social security office (SSO).

-

Set up payroll and tax withholding.

-

Prepare and file work rules (if you have 10+ employees).

-

Secure work permits/visas for global staff.

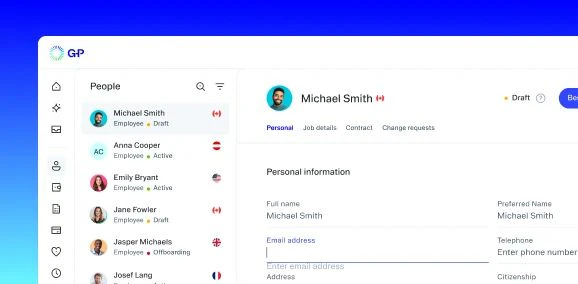

Setting up a subsidiary in Thailand can take weeks or months. Use G-P EOR to onboard full-time employees in Thailand without setting up your own entity. Build your team at a lower cost and with peace of mind that you’re doing so compliantly.

The steps to hiring employees in Thailand

The hiring process in Thailand is similar to the one you’re likely familiar with in your own country. The hiring process follows five basic steps: advertising the job, evaluating applications, interviewing candidates, sending job offers, and onboarding new employees.

1. Advertising job vacancies in Thailand

Clearly define the role, responsibilities, qualifications, and compensation. Make sure the job description and requirements comply with Thai anti-discrimination laws. JobThai, JobsDB Thailand, and JobBKK are popular job sites in Thailand.

2. Evaluating job applications in Thailand

Review applications and CVs to shortlist candidates who meet the job requirements.

3. Interviewing candidates in Thailand

Prepare standardized questions to guarantee fairness and compliance. Gia can help you create questions that follow anti-discrimination laws in Thailand, so you can find the best fit for the role while complying with local regulations. You can also include skills assessments or practical tests.

4. Making job offers in Thailand

Verify candidate credentials, employment history, and references. For certain roles, criminal background checks are allowed with candidate consent and in line with privacy laws.

Extend a formal offer letter with the terms of employment, compensation, benefits, and start date. Make sure the offer complies with Thai employment law around minimum wage, working hours, and leave.

5. Onboarding new employees in Thailand

Now you can onboard new employees. Register the new employee with the SSO within 30 days of their start date. Add the employee to the company payroll and set up tax withholding.

If you’re working with an EOR like G-P, you won’t have to worry about the administrative burden of onboarding. We’ll streamline the process, so you can focus on training your new hire and integrating them into your company culture.

Hiring contractors in Thailand

Working with independent contractors in Thailand can be a cost-effective way to test the market and build a presence without the commitment of full-time employees. Contractors based in Thailand understand local consumer behavior, rules, and business practices. They’ll be ready to start working quickly with their own equipment and established work processes.

Hiring contractors allows you to easily adjust your talent pool based on your business needs, without the complexities and costs of employment.

Before you enter an agreement with an independent contractor in Thailand, consider the following:

1. Employees vs. independent contractors in Thailand

The working relationship, not just the contract title, determines whether someone is classified as an employee or an independent contractor. Key factors include the degree of control the company has over the worker, integration into the organization, provision of equipment, method of payment, and financial risk.

Independent contractors have more autonomy, set their own schedules, use their own equipment, and are paid per project or deliverable. They don’t get employee benefits under Thai employment law. If a contractor is treated like an employee in practice, authorities can reclassify them as an employee.

2. Penalties for misclassification in Thailand

Classifying someone as a contractor when they’re not can lead to severe penalties. If misclassification occurs, you’ll have to:

-

Pay backdated social security contributions for misclassified workers, plus a penalty of 2% per month on the unpaid amount.

-

Remit the correct personal income tax for employees.

-

Provide back pay for benefits.

3. How to pay contractors in Thailand

G-P Contractor™ takes away the messy, time-consuming process of hiring and paying international contractors. You can create and issue contracts and pay contractors with a few clicks, all while ensuring a compliant process.

Hire employees and contractors in Thailand with G-P

Our SaaS and AI-powered products – EOR, Contractor, and Gia – support companies as they build and manage global teams.

G-P is the recognized leader in global employment with more than a decade of experience, the largest team of HR, legal, and compliance experts, and a global proprietary knowledge base.

Make your expansion to Thailand easier with G-P. Contact us or book a demo today.